Every customer payment entered into Micronet is flagged with a payment type. This ensures that customer payments can be grouped, reported and integrated effectively. It also ensures that bank deposit amounts will match up with bank statements when completing bank reconciliations in the General Ledger.

Some credit cards reduce the amount you receive by a commission or fee payable to the credit card company. Micronet allows you to setup these amounts so they are calculated automatically when a particular credit card payment type is specified in the Debtor Payments program.

To enter payment methods:

Refer to "Selecting a Company to Edit"

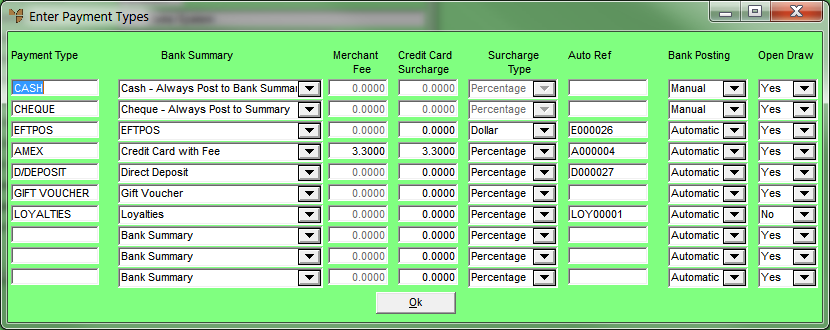

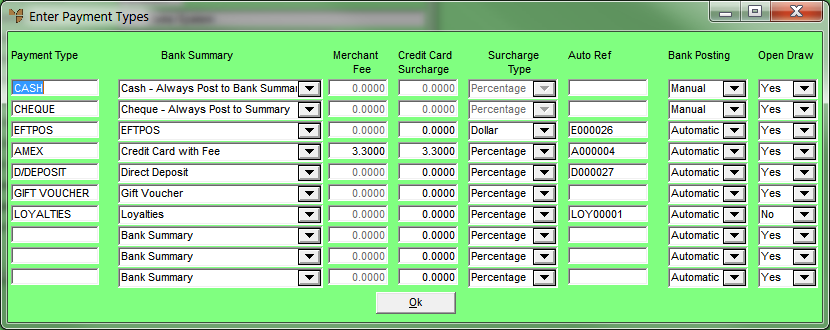

Micronet displays the Enter Payment Types screen.

|

|

Field |

Value |

|---|---|---|

|

|

Payment Type |

Enter the name or a description of the payment type that you would like to appear on Micronet screens during transaction processing. This might be, for example, CASH, CHEQUE, EFTPOS, or the name of a credit card. If you are setting up customer rebates, enter REBATES. |

|

|

Bank Summary |

Select how transactions for each payment type will be reported and integrated to the Bank Reconciliation program in the General Ledger. Micronet groups together payment amounts based on the setting chosen in this field. These payment groupings have been designed to reflect the way funds are banked or processed by the banks. For example, payments entered as a Direct Deposit are shown in the Bank Deposit Slip as individual amounts and transferred through integration to the Bank account in the General Ledger in this way. Amounts paid by EFTPOS group together and report in the General Ledger as a total rather than as individual transactions. Each Bank Summary type behaves and integrates with the General Ledger in a specific way. Options are:

Payment types flagged “Bank Summary” are payments that are transferred automatically to the Bank account in the General Ledger rather than going into an Undeposited Funds account and being manually banked via the Debtor Banking program in MDS. Direct deposits, EFTPOS payments and credit card payments fall into this category but they have their own defined payment types. You would only use this option to flag payments that do not have a specific payment type.

Payment types flagged “Non Bank Summary” are payments that do not have a specific payment type criteriah and that do not update to the Bank account.

Micronet recognises payments flagged with “Cheque” as physical cheques to be banked over the counter at the bank. Cheques will usually be totalled alongside Cash for banking, and will display in the Debtor Banking screen in MDS where users can select to add it to the Bank Deposit Slip.

Micronet recognises payments flagged with “Cash” as physical cash received to be banked over the counter at the bank. Cash will usually be totalled alongside Cheques for banking, and will display in the Debtor Banking screen in MDS where users can select to add it to the Bank Deposit Slip.

Micronet recognises payments flagged with “Credit Card ask Details” as manual credit card vouchers to be deposited over the counter at the bank. These payments will display in the Debtor Banking screen in MDS where users can select to add them to the Bank Deposit Slip. Users can also enter the credit card details for banking purposes. For more information about the Debtor Banking screen, see "Debtors Transaction Processing - Debtor Banking".

Select this option when a customer has signed a direct debit authority and payments are automatically debited from their account. Payments flagged “Direct Debit” will update to an ABA file which can be uploaded to banking software. |

|

|

|

Technical Tip The Direct Debit option is linked to debtor standing orders. Ensure that Pay Invoice is set to Yes when processing standing orders. Micronet will create a debtor payment batch, post the payments to each debtor account and flag each payment as “Direct Debit”. Ensure that each debtor has their banking details set up in the Debtors master file. Ensure that the company bank account details have been set up correctly in company maintenance. Direct debits processed to an ABA file will use the same bank details set up for direct debits in the Creditors Ledger. For more information, see the Pay Invoice field under "Maintaining the Standing Order Header". |

|

|

Bank Summary (cont.) |

Micronet recognises payments flagged with “Direct Deposit” as payments deposited or transferred directly to the Bank account by a customer. These payments will integrate individually to the Bank Reconciliation within the General Ledger. They will not display in the Debtor Banking screen.

Micronet recognises payments flagged “Credit Card with Fee” as payments deposited or transferred directly to the Bank account by a credit card company such as American Express or Diners Club International, where a fee is subtracted from the payment amount. Micronet will deduct the commission paid and the GST paid on the transaction and transfer the net payment received to the Bank Reconciliation program in the General Ledger. These payments will not display in the Debtor Banking screen. When selecting this option, the following warning displays. Select OK to clear it.

Micronet recognises payments flagged "EFTPOS" as payments deposited or transferred directly to the Bank account from an EFTPOS facility. These payments will not display in the Debtor Banking screen.

Payment types flagged "Rebate" generally refer to rebate vouchers issued to customers to encourage repeat sales. Rebates can be redeemed and used to partially or completely pay a sales invoice. Micronet will integrate the payment to the Debtor Rebates Accrued GL account to reduce provisions taken up in the General Ledger Balance Sheet. Note that Rebate payment types are linked to payment rebates setup against Inventory or Debtor master file records.

Payment types flagged as "Loyalties" refer to when customers redeem their accrued loyalty credits as payments against sales transactions in MDS, POS, MRF or MJC. Micronet will integrate the payment to the Loyalties Accrued GL account to reduce provisions taken up in the General Ledger Balance Sheet. Note that Loyalty payment types are linked to payment loyalties setup against Inventory or Debtor master file records.

Select this option if you are setting up gift vouchers. |

|

|

Merchant Fee |

Merchant fees are a cost to the business and are deducted from customer payments. A merchant fee will decrease the amount deposited to the Bank account. Payment types flagged “Credit Card with Fee”, such as American Express and Diners Club International will deduct fees from each transaction. Other credit cards, such as Mastercard or Visa, will deposit the customer payment in full and, at a later time, deduct a monthly amount for merchant fees with GST. To ensure that Micronet transfers the net payment amount for credit card transactions with fees such as American Express or Diners Club, enter the percentage amount the card company deducts from your payments received as their commission. Ensure this percentage is inclusive of GST. Micronet automatically deducts this amount from the payment and posts the appropriate amounts to your Bank Reconciliation (less the commission) and to a commissions clearing account in MGL. |

|

|

Credit Card Surcharge |

Credit card surcharges are amounts recouped from the customer for merchant fees paid on credit card transactions and are deemed income to the business. A surcharge will increase the amount deposited to the Bank account. To ensure that Micronet transfers the increased payment amount for credit card transactions with an added surcharge, enter the percentage amount or dollar amount of the surcharge fee to be included in each payment received. Ensure this percentage or dollar amount is inclusive of GST. Micronet will transfer the income item to the Profit and Loss of the General Ledger, take up the GST Collected to the Balance Sheet and update the Bank Reconciliation program with the increased payment amount received. |

| Surcharge Type |

If you entered either a Merchant Fee or a Credit Card Surcharge, select whether the figure you entered is a percentage or a fixed dollar amount. |

|

| Auto Ref |

If you would like your payment type to have an audit reference number automatically assigned, enter the text required as a prefix. Micronet will generate automatic reference numbers for each receipt where the payment type is selected. For example, if you are setting up a payment type of EFTPOS, you might enter EFT as the prefix. |

|

|

|

Technical Tip Auto Ref will populate the cheque number reference field on a customer payment. When reversing customer payments, Micronet will ask for either the reference number or the audit number. For transactions that do not generally generate a reference number, such as cash, this option provides a means to reverse payments. |

|

|

Bank Posting |

This field determines whether a payment type will update to the Undeposited Funds account in the General Ledger, or whether it will integrate automatically to the Bank Reconciliation program. Options are:

Manual payment types will transfer to the Micronet Undeposited Funds account and will display in the Debtor Banking screen in MDS where users can select to add them to the Bank Deposit Slip. These user defined amounts will integrate to the General Ledger Bank Reconciliation program.

Automatic payment types will integrate directly to the Bank account in the General Ledger and will group together and total based upon payment type and the integration configuration set up within the Micronet Distribution System. They will not update to the Undeposited Funds account. |

| Open Draw | When a cash drawer is in operation, select either Yes or No to open the drawer when the payment type is selected. |

Micronet redisplays the Change Existing Company screen.

Refer to "Logging in With Updated Configuration (Method 1)" or "Logging In With Updated Configuration (Method 2)".